Get the free mw507 form

Show details

MW507

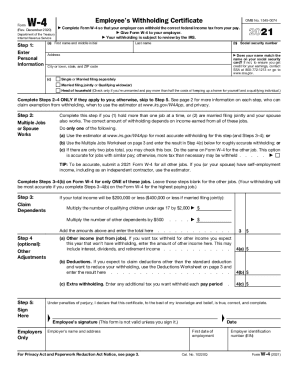

Purpose. Complete Form MW507 so that your employer can withhold the correct Maryland income tax from your pay. Consider completing a new Form MW507 each year and when your personal or financial

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your mw507 form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your mw507 form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit mw507 online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit form mw507. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, dealing with documents is always straightforward. Try it right now!

How to fill out mw507 form

How to fill out mw507:

01

Obtain the mw507 form from your employer or download it from the appropriate website.

02

Provide your personal information accurately, including your full name, Social Security number, and address.

03

Indicate your filing status by checking the appropriate box, such as single, married, or head of household.

04

If you have multiple jobs, additional income, or deductions, consult the instructions provided with the mw507 form to properly complete those sections.

05

If you wish to claim exemptions, indicate the number of exemptions you are claiming on line 5 of the mw507 form.

06

Sign and date the form before submitting it to your employer.

Who needs mw507:

01

All employees who want to adjust their withholding tax for Maryland state income taxes.

02

Individuals who anticipate that their Maryland state income tax liability will differ from the default amount withheld by their employer.

03

Employees who have had significant life changes, such as marriage, divorce, or having a child, that may impact their tax situation and require adjustments to their withholding.

Fill mw 507 : Try Risk Free

People Also Ask about mw507

Do I need to fill out a MW507 form?

What is an MW507 form?

How many exemptions should I claim MW507?

How to fill out MW507 example?

What is Maryland 2022 standard deduction?

What is Maryland State withholding Form MW507?

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is the purpose of mw507?

MW507 is a course offered by the University of Maryland University College that focuses on the principles and practices of management. It covers topics such as leadership, communication, decision-making, organizational behavior, strategy, human resource management, and operations. The course is designed to provide students with an understanding of the management concepts and processes and their application to the management of organizations.

When is the deadline to file mw507 in 2023?

The deadline to file Form MW507 in 2023 is March 31, 2023.

What is the penalty for the late filing of mw507?

The penalty for the late filing of the Michigan Withholding Tax Form MW507 is a penalty of 5% of the tax due for each month it is late, up to 25% of the total tax due.

What is mw507?

MW507 is a form used by employers in the United States to withhold the appropriate amount of state income tax from an employee's wages. It is specific to the District of Columbia (D.C.) and is used to determine the tax withholding for employees who live or work in D.C.

Who is required to file mw507?

MW507 is a form used for Maryland state income tax withholding. It is typically submitted by employees to their employers to indicate the amount of Maryland state income tax they want to be withheld from their paychecks. Therefore, employees who work in Maryland or earn income from Maryland sources are typically required to file MW507.

How to fill out mw507?

To fill out MW507, follow these steps:

1. In the Personal Allowances section, indicate the total number of allowances you are claiming for yourself and any dependents you have. The more allowances you claim, the less tax will be withheld from your paycheck.

2. If you want to request an additional amount to be withheld from each paycheck, enter the extra amount in the "Additional Withholding" section. This is optional and can be used to ensure you're not underpaying your taxes.

3. If you have multiple jobs or if you and your spouse both work, use the "Multiple Jobs Worksheet" section to calculate the additional withholding you may need to avoid underpaying.

4. In the Exempt Status section, indicate if you claim to be exempt from withholding. To be eligible for exemption, you must have had zero tax liability in the previous year and expect the same for the current year.

5. If you are a resident of D.C. or Maryland but work in Virginia, or if you are not a D.C., Maryland, or Virginia resident but work in Virginia, complete the “Nonresident Supplemental Form” section.

6. In the Signature and Date section, sign and date the form to certify that the information you provided is accurate.

7. Finally, detach the top copy of the form and submit it to your employer. Keep the remaining copies for your records.

Remember, it's always a good idea to review your tax situation with a tax professional or use a reliable tax software to ensure you are filling out the form correctly and optimizing your withholding.

What information must be reported on mw507?

MW507 is a form used to determine the amount of Maryland income tax to be withheld from an employee's wages. The following information must be reported on MW507:

1. Personal Information: This includes your name, address, Social Security Number, and the date on which you started working.

2. Filing Status: Indicate your filing status, such as single, married, head of household, or qualifying widow/widower.

3. Exemptions: Claim the number of personal and dependent exemptions to which you are entitled. Each exemption reduces the amount of income subject to taxation.

4. Additional Withholding: If you want additional Maryland income tax to be withheld from your wages, you can enter an additional amount to be deducted.

5. Nonresident Information: If you live in another state but work in Maryland, you must provide your resident state and indicate if you want the Maryland withholding to apply to your resident state.

6. Certification: Sign and date the form to certify that the information provided is accurate and complete.

Remember to keep a copy of the MW507 for your records.

How can I edit mw507 from Google Drive?

Using pdfFiller with Google Docs allows you to create, amend, and sign documents straight from your Google Drive. The add-on turns your form mw507 into a dynamic fillable form that you can manage and eSign from anywhere.

How can I send how to fill out mw507 to be eSigned by others?

Once your mw507 form how to fill out is ready, you can securely share it with recipients and collect eSignatures in a few clicks with pdfFiller. You can send a PDF by email, text message, fax, USPS mail, or notarize it online - right from your account. Create an account now and try it yourself.

How do I complete how to fill out mw507 single example on an Android device?

Use the pdfFiller mobile app to complete your mw507 form on an Android device. The application makes it possible to perform all needed document management manipulations, like adding, editing, and removing text, signing, annotating, and more. All you need is your smartphone and an internet connection.

Fill out your mw507 form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

How To Fill Out mw507 is not the form you're looking for?Search for another form here.

Keywords relevant to mw507 exemptions form

Related to maryland form mw507 example

If you believe that this page should be taken down, please follow our DMCA take down process

here

.